Tariffs and Crypto: A Silver Lining for Digital Assets

If you’ve been keeping an eye on the news lately, you’ve likely heard the buzz about tariffs—those taxes on imports that have everyone from economists to everyday investors scratching their heads. With U.S. policies under the Trump administration rolling out tariffs on major trading partners like Canada, Mexico, and China as of April 10, 2025, it’s no surprise that markets, including crypto, have felt the ripples. Pundits and doomers have been quick to paint a gloomy picture, predicting volatility and downturns.

But hold on—there’s a bright side to this story, a light at the end of the tunnel for the cryptocurrency market that’s worth celebrating. Let’s dive into how tariffs are setting the stage for a crypto comeback and why this could be one of the most exciting times to be in the space.

Tariffs: A Quick Recap

First, let’s set the scene. Tariffs are essentially government-imposed taxes on goods coming into a country, designed to protect domestic industries or nudge trade balances. Recently, the U.S. has slapped 25% tariffs on imports from Canada and Mexico and a 10% levy on Chinese goods, sparking retaliatory threats and global market jitters. The immediate reaction? Uncertainty.

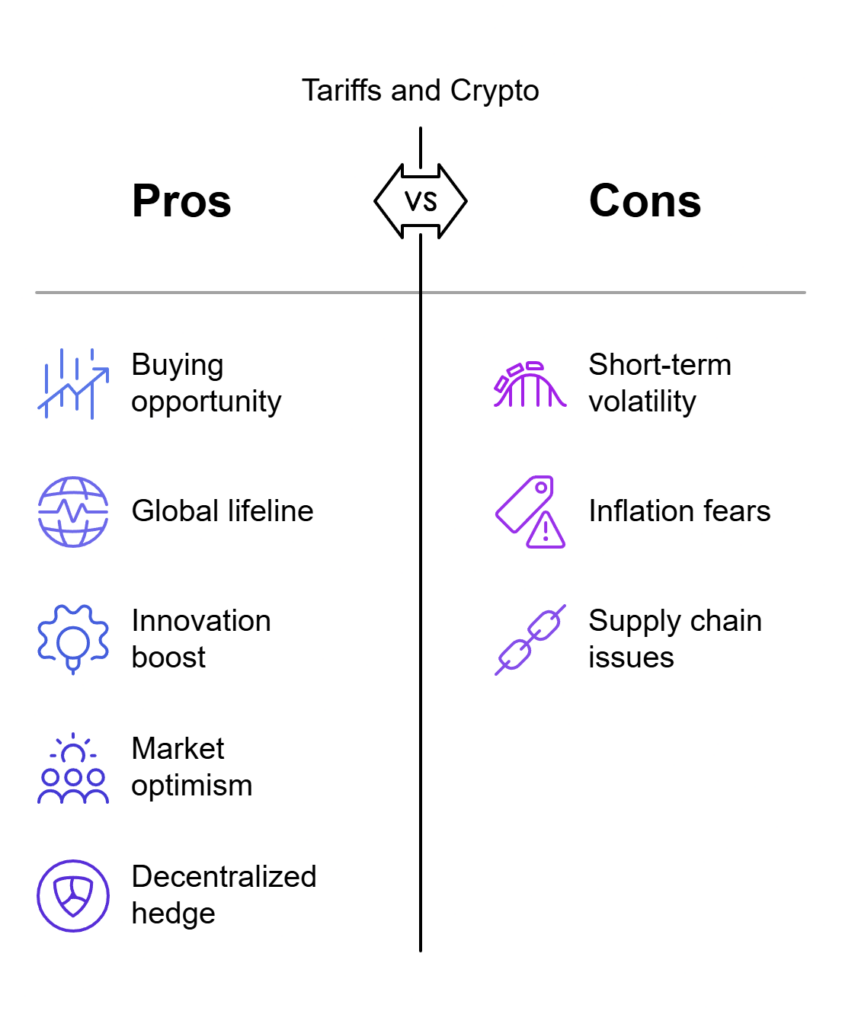

Stocks wobble, inflation fears creep in, and riskier assets—like cryptocurrencies—face short-term dips as investors recalibrate. It’s the kind of chaos that doomers thrive on, warning of economic slowdowns and crypto sell-offs. But here’s where the narrative shifts: what if this turbulence is actually laying the groundwork for something bigger and better for digital assets?

The Short-Term Shake-Up: A Hidden Opportunity

This isn’t just a fluke; it’s a pattern of recovery that hints at crypto’s underlying strength.

This isn’t just a fluke; it’s a pattern of recovery that hints at crypto’s underlying strength.Why does this happen? Tariffs stir up economic uncertainty, and while that spooks some investors into safer havens like gold, others see crypto as the ultimate hedge. Unlike traditional markets tied to physical goods, cryptocurrencies operate in a decentralized realm, unbound by trade wars or border taxes. When the system gets shaky, people start looking for alternatives—and that’s where Bitcoin, Ethereum, and even stablecoins shine.

The Long-Term Glow: Crypto as a Global Lifeline

Now, let’s zoom out for the real good news. Tariffs might just be the catalyst crypto needs to cement its place as a global financial powerhouse. Think about it: as tariffs drive up the cost of imported goods, inflation ticks up, and traditional currencies—like the U.S. dollar—face pressure. A stronger dollar might sound great, but it can hurt exporters and rattle global trade. Enter crypto, the borderless solution. In countries hit hard by trade disputes or currency devaluation, digital assets become a lifeline. We’ve seen this before—Argentina and Turkey turned to Bitcoin and stablecoins during their own economic woes, and tariff-affected nations could follow suit.

Analysts are already pointing to this potential. Some argue that tariffs could weaken the dollar’s dominance over time, opening the door for Bitcoin to step up as a global monetary player. Imagine a world where businesses bypass tariff-heavy trade routes by settling deals in crypto—fast, cheap, and free from government meddling. It’s not a pipe dream; it’s a practical response to a fragmented economy. Plus, with institutional interest growing—think companies hedging against supply chain disruptions—crypto adoption could skyrocket.

Mining and Innovation: A Domestic Boost

Here’s another upbeat twist: tariffs on tech imports, like mining hardware from China, might actually spark innovation in the U.S. crypto ecosystem. Yes, higher costs for gear could sting miners in the short term, but it’s also pushing companies to get creative. Domestic manufacturing of mining equipment could take off, reducing reliance on foreign supply chains and strengthening the U.S. as a crypto hub.

Pair that with Trump’s pro-crypto stance—think his push for a national Bitcoin stockpile—and you’ve got a recipe for a revitalized industry. The tariffs might just be the nudge needed to make the U.S. the “world capital of crypto” Trump’s been touting.

The Market’s Mood: From Fear to FOMO

Let’s talk sentiment. Posts on X and expert takes alike show a shift happening. Early tariff fears sent crypto prices on a rollercoaster, but as the reality sinks in, optimism is bubbling up. One X user noted, “The tariffs have become a crypto catalyst,” pointing to Bitcoin’s bounce-back as proof of a changing perception. Another cheered the market’s strength after tariff announcements, predicting a bullish run ahead.

Even analysts who feared the worst are softening their tone—some now say the tariff impact might already be “priced in,” leaving room for crypto to refocus on its fundamentals, which are stronger than ever.

The Light at the End of the Tunnel

So, where does this leave us? Tariffs may have rattled the crypto market, but they’re also lighting a path forward. Short-term volatility? Sure, but it’s a chance to buy the dip. Long-term potential? Massive, as crypto steps up as a hedge, a trade tool, and a symbol of financial freedom.

Forget the doomers—tariffs aren’t the end of crypto; they’re a springboard. As global trade reshuffles and economic uncertainty lingers, digital assets are poised to thrive, offering a decentralized escape hatch from the chaos.

Ready to get started?

Stay informed. Stay secure. Happy investing!