Plasma went live with $2B+ in TVL!

Plasma, the new kid on the block that’s turning heads with its promise of zero-cost stablecoin transfers. It launched with over $2 billion in locked value right out of the gate, backed by Tether affiliates and top-tier investors like Peter Thiel.

The big question: Can it actually deliver on that bold vision, or is it just another hype cycle?

Why Plasma Stands Out in a Crowded Crypto World

Stablecoins have quietly become the backbone of crypto. Think about it: USDT alone handles more than $12 trillion in transactions every year—that’s way bigger than PayPal’s volume. But the networks they rely on, like Ethereum, Tron, or Solana, still come with headaches: pesky fees, scaling bottlenecks, and that nagging friction that keeps them from feeling like true digital cash.

Plasma flips the script. Instead of trying to be everything to everyone, it’s laser-focused on stablecoins. By subsidizing transfers and aligning directly with them, it aims to create a network that’s free, lightning-fast, and rock-solid stable. This isn’t just for traders flipping assets; it’s got real appeal for merchants, everyday payments, and even cross-border remittances.

From an investor’s perspective, Plasma isn’t reinventing the wheel—or the money. It’s smartly betting on the existing giants in stablecoin flows, carving out a niche that could pay off big if it sticks.

Breaking Down Plasma’s Tokenomics: What Makes XPL Tick?

At the heart of Plasma is its native token, XPL. Here’s a closer look at its structure, utility, and market positioning to help you decide if it’s worth your portfolio.

Supply and Distribution

-

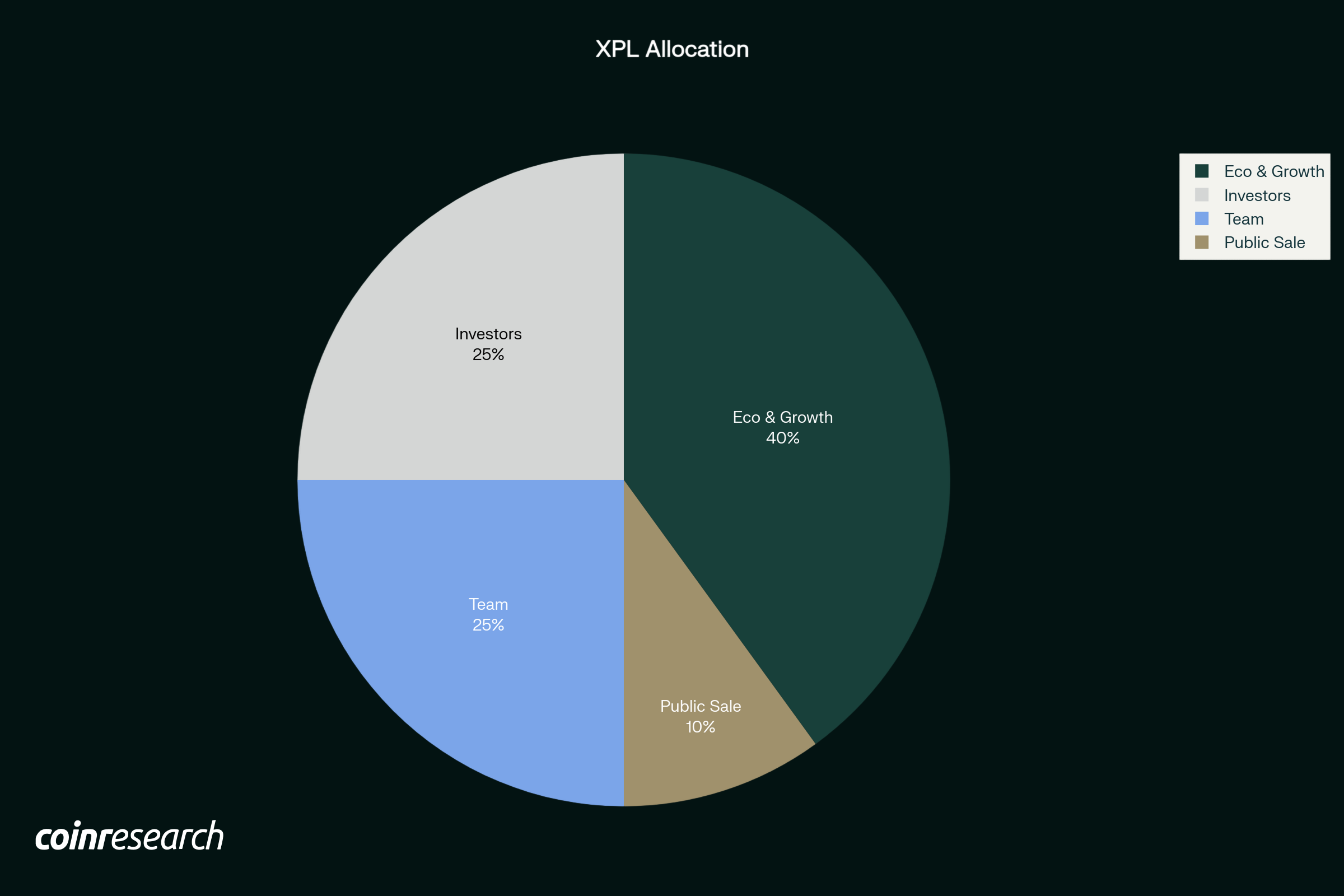

Total Supply: 10 billion XPL

-

Circulating at Launch: Roughly 1.6 billion (about 16%)

-

Big chunks are allocated to the ecosystem and investors, but they’re vested over time. This setup curbs short-term dumping but introduces dilution risks down the line as more tokens unlock, potentially pressuring the price if adoption doesn’t keep pace.

Real Utility That Drives Demand

-

Gas Abstraction: Users get fee-free transfers, while validators and infrastructure get subsidized via XPL—keeping the network humming without users feeling the pinch. This creates ongoing demand as the network scales.

-

Governance: Hold XPL, and you get a say in upgrades and economic tweaks, empowering the community to shape the protocol’s future.

-

Staking: Validators earn yields for securing the chain, tying XPL’s value directly to network growth and adoption. As more stablecoins flow through Plasma, staking rewards could attract long-term holders.

How It Stacks Up Valuation-Wise

-

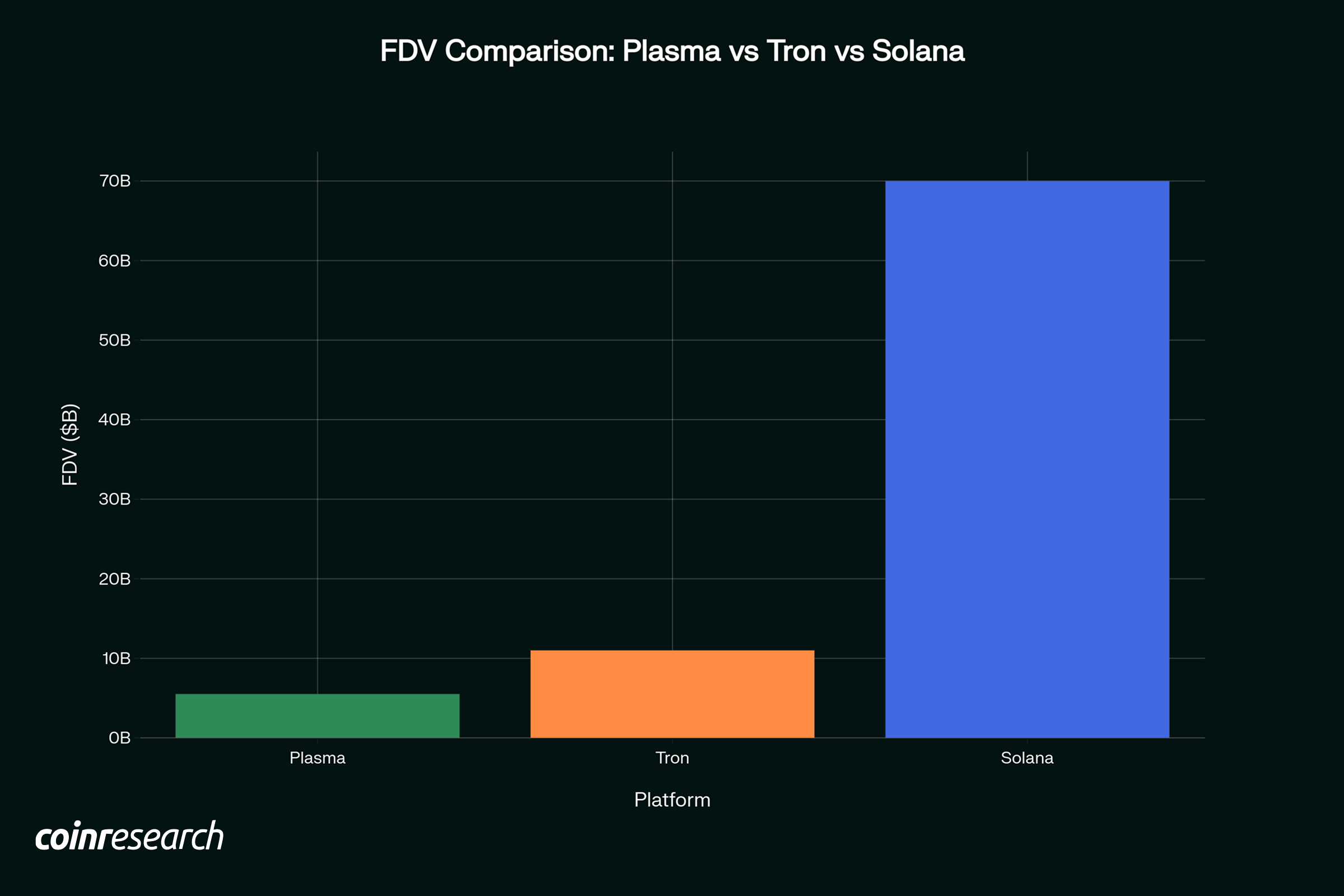

Launch FDV (Fully Diluted Valuation): Around $5–6 billion.

-

Compare that to Tron (~$11B FDV with $50B+ in stablecoin settlements) or Solana (~$70B FDV with a $200B+ ecosystem).

-

Right now, Plasma feels like a mid-tier Layer 1 chain—not yet the go-to for payments, but with room to climb if it captures market share from incumbents

The Investment Case for XPL: Weighing Short, Medium, and Long-Term Potential

Diving deeper into the investment angle, Plasma’s XPL token presents a compelling but nuanced opportunity. It’s not a slam-dunk; success hinges on execution, adoption, and navigating crypto’s wild swings. Let’s break it down by time horizon, highlighting why it could be a good (or bad) bet.

Short-Term Outlook (Next 3–6 Months): Riding the Launch Wave with Caution

In the immediate short term, XPL could be a thrilling investment for those chasing quick wins, fueled by post-launch hype and Tether’s ecosystem ties. With $2B+ TVL already in place, early buzz from influencers, exchanges listings, and initial user onboarding could spark a price pump—potentially 50–100% gains if positive metrics (like daily transfers or partnerships) hit the headlines. The zero-fee appeal might draw in speculative traders, boosting liquidity and sentiment-driven rallies in a bull market.

That said, short-term could turn sour fast, making it a bad bet for conservative players. Launch tokens often face volatility from unlocks, airdrop farmers dumping, or undiscovered bugs causing network hiccups. Broader crypto sentiment—tied to Bitcoin halving cycles or macro events—could trigger sharp corrections, wiping out early gains. If spam issues emerge early or Tether faces any negative news, XPL might drop 30–50% or more. Overall, it’s good for agile traders who can time entries/exits, but bad for buy-and-hold types expecting stability—focus on monitoring TVL and volume for signals.

Medium-Term Outlook (6–18 Months): High Upside with Volatility Risks

In the medium term, Plasma could shine as a strong investment if it builds on its launch momentum. With $2B+ in TVL already locked in, early adoption metrics look promising—especially if real-world payment volumes ramp up beyond initial hype. The zero-fee model could attract merchants and users frustrated with Ethereum’s gas costs or Tron’s limitations, potentially driving XPL demand through staking and subsidies. If Plasma sustains this TVL and hits key milestones like integrations with major wallets or exchanges, we could see a rerating toward Tron’s multiples, implying a 2–3x upside from current levels.

On the flip side, this period is fraught with risks that could make it a poor choice. Spam and congestion from free transfers might force tweaks that undermine the core promise, leading to user exodus. Regulatory scrutiny on Tether (USDT) looms large—any crackdown could directly crater Plasma’s liquidity. Competition from established chains like Solana, with its developer ecosystem, might keep Plasma sidelined. Market volatility could amplify these issues; a broader crypto downturn might push FDV down to $1–2B, erasing gains for early holders. Overall, medium-term it’s a good bet for risk-tolerant investors betting on quick growth, but bad for those seeking stability—expect wild price swings tied to news and metrics.

Long-Term Outlook (2+ Years): Transformative Potential vs. Existential Threats

Looking further out, Plasma has the makings of an excellent long-term investment if it cements itself as the “digital dollar rail.” Successful governance and staking could foster a virtuous cycle: more adoption leads to higher yields, attracting more validators and holders, which in turn boosts security and value. If Plasma evolves to handle enterprise-level payments or integrates with Web3 apps, XPL could achieve 5–10x returns, outpacing many L1s by becoming indispensable infrastructure.

However, long-term risks could render it a bad investment if structural flaws emerge. Dilution from vesting schedules might dilute value if growth stalls, turning XPL into a forgotten mid-cap token. Technical complexities—like bridges and consensus tweaks—raise the odds of exploits, which could permanently damage trust in a crowded field. Broader threats include evolving regulations that favor centralized stablecoins or kill off USDT entirely, or superior tech from competitors eclipsing Plasma. In a worst-case scenario, it fades into obscurity like many hyped chains. That said, for patient investors who believe in stablecoin dominance, it’s a solid long-term play—bad only if the team fails to innovate or external forces (regs, hacks) intervene decisively.

-

The Risks: No Rose-Tinted Glasses Here

Of course, crypto landscape is full of uncertainty, but Coinresearch stands as your reliable guide for savvy investors. That said, Plasma’s innovative vision brings notable challenges to the table:

-

Spam and Network Overload: Free transfers sound great, but they could attract bots and congestion. If the team has to add throttling or collateral requirements, that “no-fee” magic disappears.

-

Regulatory Headwinds: It’s heavily tied to USDT, so any Tether drama or broader stablecoin crackdowns could tank adoption overnight.

-

Fierce Competition: Ethereum, Tron, and Solana have massive liquidity pools and developer communities. Plasma needs to prove it can pull in loyal users.

-

Tech and Security Challenges: With bridges, paymasters, and custom consensus, complexity is high—leaving room for bugs or exploits that erode trust fast.

-

Market Swings: Like any crypto token, XPL is vulnerable to broader volatility and stablecoin shocks.

Wrapping It Up: High Stakes, High Potential

Plasma’s story is compelling: A blockchain built specifically for stablecoin payments, with strong ties to Tether’s ecosystem, and kicking off with billions in TVL. That’s not something you see every day in this space.

The upside? If it evolves into the ultimate “digital dollar highway,” XPL could deliver returns that outpace most new chains. If you’re intrigued, keep an eye on usage metrics as they roll in.

Worth a spot on your watchlist? Absolutely.

If you enjoyed this research insight, hit the subscribe button below for more crypto breakdowns straight to your inbox. For deeper research, early-stage project opportunities, and access to predictive analytics, join our Coinresearch AI platform starting at just $9/month (And yes, prices are going up soon!)